Introduction

OLED (Organic Light-Emitting Diode) technology is rapidly reshaping the global display market, offering unprecedented advantages over traditional LCD and LED displays. From smartphones and TVs to cutting-edge AR/VR devices, OLED is at the center of a technological revolution. This definitive guide provides a deep dive into the OLED industry, including material definitions, applications, industrial chain structure, government support, market size, key players, competitive landscape, future trends, financial characteristics, and strategic analysis using Porter’s Five Forces and the Morningstar Moat framework.

If you’re an investor, industry professional, or technology enthusiast looking to understand the current state and future prospects of the OLED industry, this comprehensive resource is for you.

1. What is OLED? Definition, Applications, and Classification

1.1 OLED Material Definition

OLED materials are the final products in the OLED organic material production chain, obtained through sublimation purification processes from intermediates or precursor materials. These end materials form the core of OLED panels, directly determining their luminous efficiency, color accuracy, and lifespan. High technical barriers and strict quality standards make OLED materials one of the most advanced and competitive segments of the global display industry.

1.2 OLED Applications

OLED materials are used extensively in:

Smartphones and Tablets: Flexible, high-resolution displays with deep blacks and vibrant colors.

Wearable Devices: Smartwatches and fitness trackers benefit from OLED’s thinness, flexibility, and low power consumption.

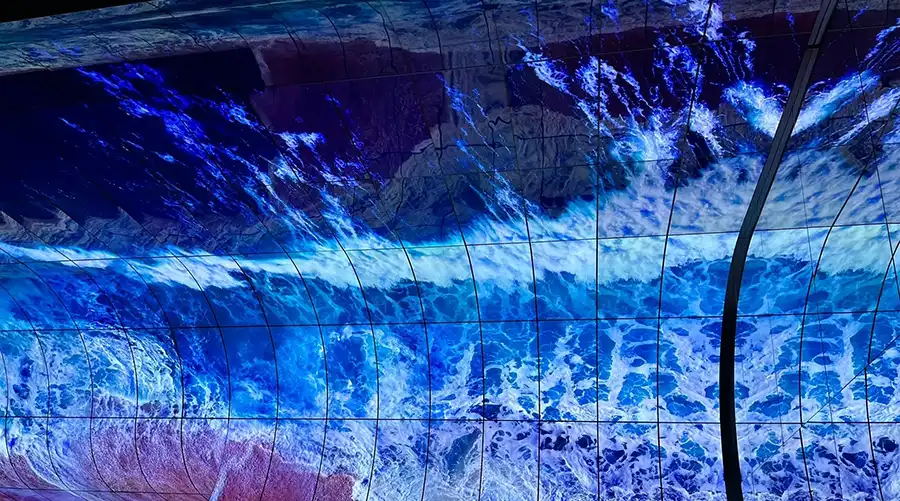

Televisions: Premium TVs featuring superior color performance and contrast.

Automotive Displays: Instrument clusters, infotainment systems, and heads-up displays.

AR/VR Headsets: Micro OLED panels for ultra-high pixel density and fast response.

Lighting: Innovative lighting panels for commercial and residential use.

Aerospace and Defense: Specialized screens for avionics and military equipment.

1.3 OLED Material Classification

OLED materials are typically divided by their function in device architecture:

Emissive Layer Materials (EML): Red, green, and blue emissive materials, including hosts and dopants.

Hole Transport Layer (HTL) Materials: Facilitate the movement of positive charges (holes).

Electron Transport Layer (ETL) Materials: Facilitate the movement of negative charges (electrons).

Hole Injection Layer (HIL) and Electron Injection Layer (EIL): Optimize charge injection from electrodes.

Other Functional Layers: Including buffer layers and encapsulation materials.

By chemical structure, OLED materials are also classified as:

Small Molecule Materials: Mainstream, offering high efficiency and stability, suitable for vacuum deposition.

Polymer Materials: Emerging, with strong processability but still under development for mass market use.

2. Government Support and Strategic Industrial Positioning

2.1 National Policy Support

The OLED materials industry is a strategic priority for the Chinese government. Since 2006, policies and regulations have been rolled out to promote R&D, industrialization, and supply chain development. Key policies include:

National Medium and Long-term Science and Technology Development Plan (2006–2020)

Decision of the State Council on Accelerating the Cultivation and Development of Strategic Emerging Industries

Special Plans for New Display Technologies (including OLED)

“Made in China 2025” Initiative: Emphasizes breakthroughs in key materials and equipment for advanced manufacturing.

Since 2021, tax incentives and duty-free imports for advanced raw materials and consumables have directly benefited the OLED materials sector.

2.2 Local Government Initiatives

Provinces and cities such as Guangdong and Shenzhen have issued measures to encourage the high-quality development of new materials clusters, including OLED materials. These include direct funding, R&D subsidies, and support for industry alliances.

2.3 Guangdong Province: Strategic Sectors

Guangdong, China’s innovation hub, lists “Ultra High-Definition Video Display” and “Frontier New Materials” as both pillar and emerging strategic industries. OLED materials development is a key component of these clusters, supported by innovation roadmaps, tax breaks, and targeted investment.

3. OLED Industry Chain: Structure and Risks

3.1 Industry Chain Structure

The OLED industry chain consists of three major segments:

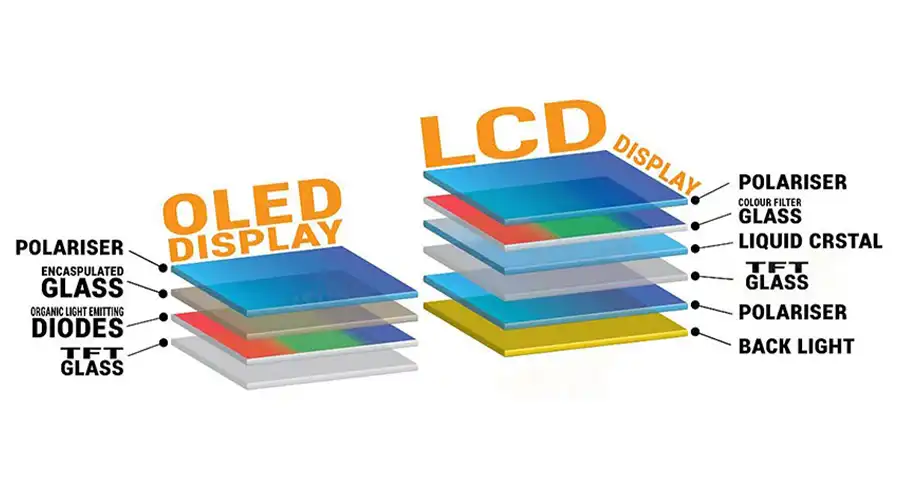

Upstream: Equipment manufacturing (lithography, etching, coating, encapsulation), material production (substrates, electrodes, OLED end materials), and component assembly (ICs, circuit boards).

Midstream: OLED panel assembly and manufacturing, integrating upstream materials and processes into finished modules.

Downstream: End-user applications such as smartphones, TVs, lighting, automotive displays, and emerging AR/VR devices.

(Insert industry chain diagram or link here for illustration.)

3.2 Key Risk Areas

Technology Barriers: Core patents and proprietary processes are dominated by international players (Samsung SDI, LG Chem, Idemitsu Kosan, UDC, Merck, etc.).

Supply Chain Dependence: High-purity materials and critical precursors are mostly imported. Domestic substitution rate remains low, especially for terminal materials.

Entry Barriers: Suppliers must pass long and stringent certification cycles (2–3 years), making it difficult for new entrants to gain significant market share.

Market Competition: Patent expiry and the rise of domestic firms are increasing competition, squeezing margins.

Raw Material and Inventory Risks: Price fluctuations and inventory management challenges affect profitability.

Geopolitical and Compliance Risks: Operating across Asia, Europe, and the US brings exposure to regulatory and political uncertainties.

Technology Iteration: Rapid advances require continuous R&D investment; lagging behind leads to obsolescence.

4. OLED Market Size and Competitive Landscape

4.1 Global Market Overview

2024 Market Size: The global OLED material market is estimated at $2.11 billion.

2031 Forecast: Expected to reach $4.338 billion, with a CAGR of 11.0%.

Market Concentration: The top three international firms control over 65% of the market, with Samsung SDI and LG Chem alone accounting for about 70%.

4.2 China Market Overview

2023 Market Size: China’s OLED organic material market reached RMB 4.3 billion (approx. $600 million), up 33% YoY.

2030 Forecast: Expected to hit RMB 9.8 billion (~$1.4 billion), with a projected CAGR of 11.0%.

Localization Rate: Domestic firms have made progress in intermediates and precursor materials, but end-material localization remains below 20%.

4.3 Competitive Landscape

Global Leaders: Samsung SDI, LG Chem, Idemitsu Kosan, UDC, Dow Chemical, Merck.

China’s Domestic Players: Laite Optoelectronics, Visionox, BOE, Royole, and others, with growing but still modest market shares.

Segment Analysis

Emissive Materials: UDC (US) and Dow Chemical dominate red/green phosphorescent materials; Idemitsu Kosan and Merck lead in blue materials.

Universal Materials: LG Chem, Samsung SDI, Toray (Japan), Merck, and UDC dominate, leveraging patent portfolios and technology leadership.

5. Future Market Trends and Technology Roadmap

5.1 Technology Evolution

Flexible OLED: Rapid adoption in smartphones and wearables, with foldable and rollable displays gaining traction.

QD-OLED and Printed OLED: Next-generation manufacturing processes aim to lower costs and expand large-size applications.

Micro OLED: Ultra-high resolution displays for AR/VR, medical, and military uses—a global growth hotspot.

Phosphorescent Materials: Transition from fluorescent to phosphorescent materials boosts efficiency and lifetime.

5.2 Market Drivers

Consumer Electronics: OLED penetration in smartphones exceeds 50%; TV and laptop adoption rising.

Automotive & AR/VR: Demand for flexible, high-resolution panels in cars and immersive headsets is surging.

Localization Push: Government policy, supply chain security, and rising domestic capability are accelerating the replacement of imported materials.

5.3 Challenges

Cost Pressures: While manufacturing costs are falling, initial investments remain high.

Patent Barriers: International patent portfolios continue to limit the scope of domestic innovation.

Alternative Technologies: Mini LED and Micro LED are emerging competitors in high-end markets.

6. OLED Industry Characteristics and Financial Metrics

6.1 Industry Features

High Technical Barriers: Advanced R&D, strict purity, and proprietary know-how required.

Customer Concentration: Major panel makers (e.g., BOE, Samsung, LG) account for the majority of material supplier revenues.

Long Certification Cycles: 2–5 years for new material authentication by panel makers.

6.2 Financial Characteristics

Revenue and Profit Growth: Leading firms such as Laite Optoelectronics have reported 56.9% YoY revenue growth and 116.68% net profit growth in 2024.

Gross Margin: End-material gross margins range from 65–70% (Laite Optoelectronics), while intermediates are lower (23–24%).

Cost Structure: Raw materials account for ~55% of costs, manufacturing expenses ~38%, with relatively low labor costs.

R&D Intensity: R&D expenditure rates can exceed 18%, reflecting the need for constant innovation.

Market Concentration Risks: Heavy reliance on a few panel makers increases vulnerability to demand shifts.

7. Key Listed Companies in the Chinese OLED Industry Chain

Here are some representative Chinese public companies across the OLED value chain:

| Segment | Company Name (Ticker) | Main Business |

| End Materials | Laite Optoelectronics (688150) | Emissive and transport layer materials |

| End Materials | Oled (688378) | Leading domestic OLED organic material supplier |

| Intermediates | Ruilian Xincai (688450) | Customized intermediates, liquid crystal materials |

| Intermediates | Puyang Huicheng (301128) | OLED material producer in global supply chain |

| Panel Manufacturing | BOE A (000725) | AMOLED and flexible display panels |

| Panel Manufacturing | Visionox (002387) | AMOLED panels, foldable display technology |

| Equipment/Components | Jingce Electronics (300567) | Inspection equipment, PI films |

| Equipment/Components | Qingyue Technology | OLED-related equipment and materials |

8. Porter’s Five Forces Analysis: OLED Materials Industry

Applying Porter’s Five Forces framework provides strategic insights for investors and businesses in the OLED materials sector.

Supplier Power: High. Core patents, technology, and high-purity precursors are controlled by a few international giants, leading to strong bargaining power.

Buyer Power: Medium-High. Panel makers are highly concentrated (BOE, Samsung, LG), but material certification is long and costly, reducing switching frequency.

Threat of New Entrants: Low. High technical barriers, long customer certification cycles, and extensive patent protection deter new players.

Threat of Substitutes: Medium. Mini LED and Micro LED technologies are viable alternatives in premium markets, but OLED’s flexibility and contrast remain unique advantages.

Industry Rivalry: Intense. International leaders dominate, but domestic players are rising fast, leading to fierce competition, price pressure, and rapid innovation.

9. Morningstar Moat Analysis: Competitive Advantages of OLED Firms

Intangible Assets: Leading players hold proprietary patents, providing legal and technical protection.

Switching Costs: Long material certification cycles and high switching costs ensure customer stickiness.

Cost Advantage: Larger firms benefit from economies of scale and supply chain integration.

Efficient Scale: Though domestic firms have low current market share, government support and investments are driving rapid expansion.

Network Effects: Limited in materials, but vertical integration with panel makers can create collaborative advantages.

Moat Rating: Most Chinese OLED materials firms currently possess a “narrow moat”—competitive but not yet unassailable. Continued innovation and patent breakthroughs are needed to achieve a “wide moat” status.

10. Conclusion: The Outlook for the OLED Industry

The OLED industry is experiencing rapid and sustained growth, driven by rising demand for high-performance displays, robust government support, and relentless technological innovation. While international giants dominate core materials, Chinese firms are making impressive progress, especially in intermediate and precursor materials.

Looking forward, the key to success in the OLED sector lies in:

Breaking patent bottlenecks through indigenous innovation and R&D investment.

Achieving end-material localization to ensure supply chain security.

Seizing new opportunities in flexible, foldable, and AR/VR display markets.

Building deeper partnerships along the industry chain, from raw material suppliers to final product makers.

For investors, entrepreneurs, and technology companies, the OLED sector will remain one of the most dynamic and promising fields in the next decade.

Recommended Reading

Feel free to link to this page as a comprehensive resource on the OLED industry. For content partnerships or further information, contact us!

Latest articles

-

The Ultimate Guide to the OLED Industry: Market Analysis, Key Players, and Future Trends (2025 Edition)

The Ultimate Guide to the OLED Industry: Market Analysis, Key Players, and Future Trends (2025 Editi

-

Best OLED Display 2025 – The Ultimate Guide

Discover the top OLED displays of 2025 with our ultimate guide. Explore cutting-edge technology, AMO

-

Exploring OLED Technology: Beyond Traditional Displays (2025 Update)

What is an OLED? A 2025 Guide to Organic Light-Emitting Diodesbody { font-family: 'Roboto', sans-ser

-

IPS Display Mode: The Backbone of Modern TFT LCD Technology

Discover the advantages of IPS display mode in TFT LCDs, including wide viewing angles, superior col

-

OLED vs IPS Displays: A Comprehensive Guide to Choosing the Right Technology

Discover the differences between OLED and IPS displays. Learn which technology offers better color,

Recommended products

-

1.93" OLED display I2C 368x448 Industrial-Grade Panel

Shenzhen Brownopto Technology’s 1.93-inch AMOLED module (Model BR193103-A1) features a core advantag

-

2.06-inch OLED Display | 410×502 Resolution | 600 Nits | SPI Screen

The 2.06-inch AMOLED display module is designed specifically for harsh industrial environments, feat

-

3.92" OLED Display I2C Interface 1080 × 1240 Resolution

Product Specifications: BRO392001AResolution: 1080x1024Operating Voltage Range: 28VScreen Size: 3.92

-

4.39" OLED display module I2C Interface 568×1210 Resolution

The 4.39-inch AMOLED display module (model BR439102-A1) introduced by (Shenzhen Brownopto Technology

-

5.48" OLED Display Module - 1080x1920 I2C, MIPI DSI, Industrial

Product Specifications: BRO548001AResolution: 1080x1920Operating Voltage Range: 2.8VScreen Size: 5.4

-

6.01" OLED Display | High Definition 1080x2160 | MIPI Interface

Product Specifications: BRO601001ADisplayMode: AMOLED Screen Size (inch): 6.01 Resolution: 1080x2