Discover the top OLED display manufacturers driving global innovation in display technology

Introduction to OLED Display Manufacturing

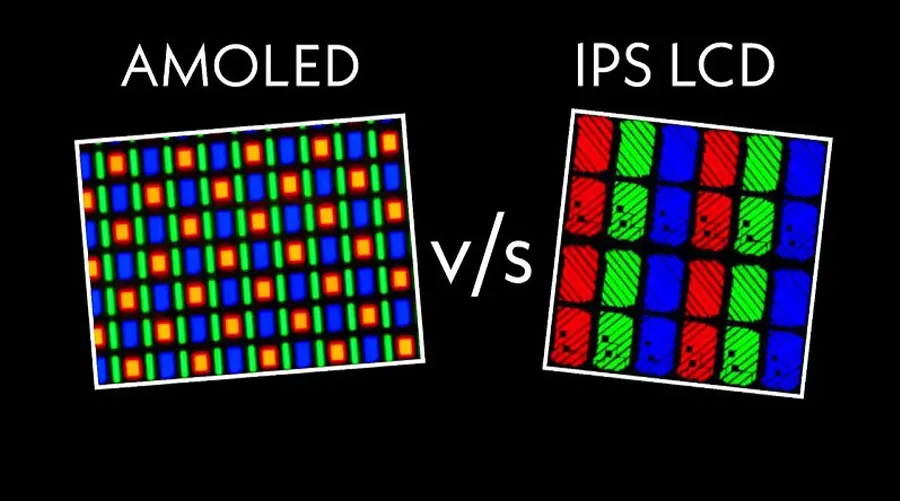

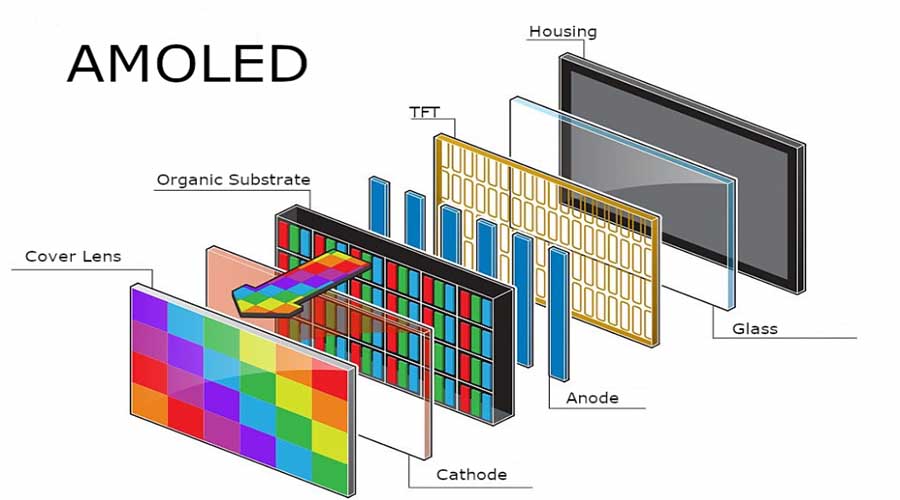

OLED (Organic Light-Emitting Diode) technology has revolutionized the display industry with its self-emissive properties, enabling thinner, brighter, and more energy-efficient screens. As demand for high-performance displays grows across smartphones, TVs, automotive, and wearable devices, leading OLED display manufacturers are at the forefront of innovation. This article explores the top manufacturers, their technological advancements, and the evolving market dynamics shaping the OLED industry.

The OLED display market is projected to reach $350 billion by 2028, driven by the adoption of flexible, transparent, and ultra-thin displays. Manufacturers like Samsung Display, LG Display, BOE, and Visionox are leading the charge, leveraging advanced production techniques and R&D investments to meet global demand. This section provides an overview of the industry landscape and key players shaping its future.

Top Global OLED Display Manufacturers

Below are the leading OLED display manufacturers, categorized by their market focus and technological strengths:

1. Samsung Display (South Korea)

Core Strengths: Dominates the small- and medium-sized OLED market with cutting-edge AMOLED technology for smartphones and wearables.

Key Products: Flexible AMOLED panels for Galaxy smartphones, transparent OLEDs for AR/VR, and RGB Tandem OLEDs for high-brightness displays.

Market Position: Holds over 30% of the global OLED panel market and leads in QD-OLED development.

Recent Innovations: Launched 1500-nit OLED displays for premium TVs and notebooks, and QD-EL prototypes with 400-nit brightness.

2. LG Display (South Korea)

Core Strengths: Specializes in large-format OLED panels for TVs and commercial displays, with expertise in flexible and transparent OLEDs.

Key Products: Signature OLED TVs, 88-inch transparent OLEDs, and hybrid tandem OLEDs for improved efficiency.

Market Position: Leading provider for Apple’s iPhone OLED panels and a key player in automotive displays.

Recent Innovations: PHOLED (Phosphorescent OLED) technology for IT displays and Primary RGB Tandem OLEDs for TVs.

3. BOE (China)

Core Strengths: Rapidly expanding into both small- and large-size OLED markets with high-capacity production lines in China.

Key Products: 6-gen AMOLED panels for smartphones, curved OLEDs for automotive dashboards, and flexible OLEDs for foldable devices.

Market Position: Second-largest OLED manufacturer globally, with growing presence in the Chinese smartphone supply chain.

Recent Innovations: Developed ultra-thin OLEDs for wearable devices and low-power consumption solutions for IoT applications.

4. Visionox (China)

Core Strengths: Focus on flexible and ultra-thin OLEDs for smartphones and automotive applications, with partnerships in Huawei and Xiaomi ecosystems.

Key Products: 7.2-inch flexible folding screens with 1.6mm bend radius, automotive OLED dashboards, and low-power AMOLEDs.

Market Position: Rising star in the Chinese OLED market, with 11% share in Q3 2024 small OLED shipments.

Recent Innovations: Launched wideband LTPS technology for AMOLEDs, enabling 20Hz–640Hz adaptive refresh rates.

5. Japan Display Inc. (Japan)

Core Strengths: Known for high-quality AMOLEDs in mid-range smartphones and industrial displays.

Key Products: High-resolution AMOLEDs for tablets, automotive displays, and medical-grade monitors.

Market Position: Strong presence in the Japanese and Southeast Asian markets, with growing interest in flexible OLEDs.

Recent Innovations: Collaborated with Sony to develop transparent OLEDs for smart windows and interactive kiosks.

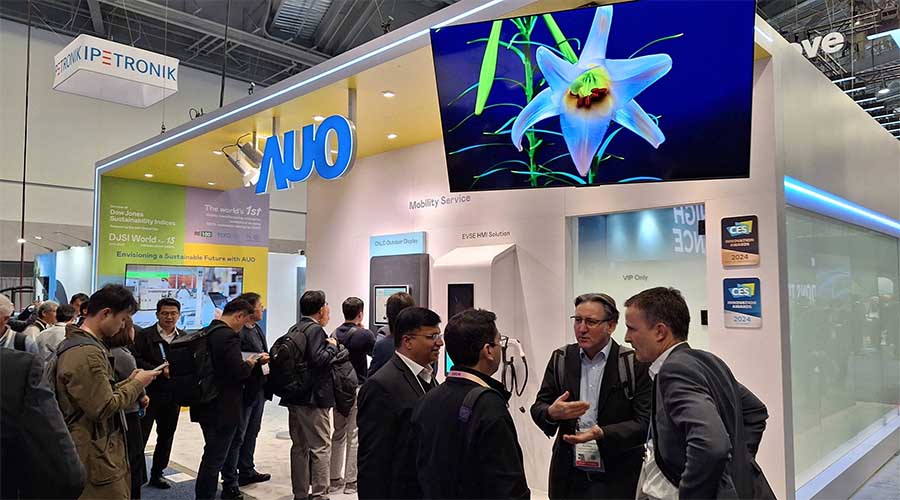

6. AU Optronics (Taiwan)

Core Strengths: Diversified portfolio covering both rigid and flexible OLEDs for consumer electronics and industrial use.

Key Products: 27-inch OLED monitors, transparent OLEDs for retail displays, and automotive infotainment systems.

Market Position: Key supplier to brands like Dell and HP for high-end OLED monitors.

Recent Innovations: Integrated AI-driven quality control systems to improve production yields.

7. Tianma Microelectronics (China)

Core Strengths: Specializes in high-resolution AMOLEDs for tablets, laptops, and automotive displays.

Key Products: 13.3-inch OLED panels for laptops, curved automotive dashboards, and low-power wearable displays.

Market Position: Growing presence in the Chinese automotive and consumer electronics markets.

Recent Innovations: Developed eco-friendly OLED materials to address e-waste concerns.

Technological Breakthroughs in OLED Production

OLED manufacturers are driving innovation through advancements in materials, manufacturing processes, and design flexibility. Key developments include:

Hybrid Tandem OLEDs: LG and Samsung have introduced multi-layer OLED structures to enhance brightness and efficiency, reducing power consumption by up to 15%.

QD-OLED Technology: Samsung’s QD-EL (Quantum Dot Electroluminescence) prototypes use cadmium-free quantum dots to achieve 400-nit brightness, surpassing traditional OLEDs.

Flexible and Stretchable OLEDs: Companies like Royole and Visionox are developing ultra-thin, foldable, and stretchable OLEDs for wearables and haptic feedback devices.

Transparent OLEDs: LG and Sony are commercializing see-through OLEDs for smart windows, AR glasses, and interactive retail displays.

Low-Power Solutions: Visionox’s wideband LTPS technology enables adaptive refresh rates (20Hz–640Hz), optimizing energy use for mobile devices.

Case Study: LG Display’s PHOLED panels for IT devices combine phosphorescent materials with hybrid tandem structures, achieving 1500-nit peak brightness while maintaining energy efficiency. This technology is expected to be adopted in 2026 notebooks and monitors.

Market Growth and Industry Trends

The OLED display market is expanding rapidly, driven by demand for high-performance screens in key sectors:

1. Smartphone and Wearables

Market Share: OLEDs now account for over 70% of flagship smartphones, with AMOLEDs dominating due to superior color accuracy and flexibility.

Key Players: Samsung Display supplies 80% of Apple’s iPhone OLED panels, while BOE and Visionox serve Xiaomi and Huawei.

Trend: Foldable smartphones are gaining traction, with 2025 shipments projected to exceed 20 million units globally.

2. Automotive Displays

Growth Drivers: Curved dashboards, transparent HUDs, and rear-seat entertainment systems are accelerating OLED adoption in vehicles.

Key Players: LG Display partners with Mercedes-Benz, while BOE supplies BMW and Tesla with automotive OLEDs.

Trend: OLEDs are replacing LCDs in luxury vehicles for their contrast ratios and design versatility.

3. Television and Home Entertainment

Market Share: LG and Samsung lead the OLED TV segment, with LG holding 52% of the 2025 Q1 market.

Trend: 8K and 120Hz OLED TVs are becoming mainstream, supported by HDR and gaming features.

4. Industrial and Commercial Applications

Applications: Transparent OLEDs are being used in smart retail kiosks, while flexible OLEDs enable dynamic architectural lighting.

Key Players: Sony and BOE are developing large-format transparent OLEDs for commercial signage and smart buildings.

Real-World Example: BOE’s 88-inch transparent OLED was showcased at the 2025 Shanghai World Expo, demonstrating its potential for interactive retail and public displays.

Challenges Facing OLED Manufacturers

Despite rapid growth, OLED manufacturers face several challenges that could impact long-term sustainability:

Material Costs and Supply Chain Constraints: Organic materials and driver chips remain expensive and subject to global supply chain disruptions.

Production Complexity: Large-format OLEDs require precise laser patterning and vacuum deposition, increasing manufacturing costs.

Lifetime Degradation: Blue OLEDs degrade faster than red/green ones, limiting lifespan in high-brightness applications.

Environmental Concerns: E-waste from discarded OLED devices is a growing issue, prompting R&D into biodegradable materials.

Solution Spotlight: Samsung Display and LG are investing in recycling technologies to recover rare materials from end-of-life OLED panels. Additionally, companies like Konica Minolta are experimenting with biodegradable OLED materials to reduce environmental impact.

Future Innovations and Opportunities

The OLED industry is poised for transformative advancements in the coming years, driven by emerging technologies and market demands:

Micro-LED Integration: Hybrid OLED-MicroLED panels could combine the self-emission of OLEDs with the durability of inorganic LEDs.

AI-Driven Manufacturing: Machine learning is being used to optimize production yields and reduce defects in OLED fabrication.

Biodegradable OLEDs: Research into organic compounds that decompose naturally could address e-waste challenges.

Stretchable OLEDs: Elastomeric substrates will enable wearable health monitors and haptic feedback devices.

Printed OLEDs: Inkjet printing for large-area, low-cost displays in signage and smart packaging.

Future Outlook: By 2028, OLEDs are expected to dominate the premium smartphone and TV markets, while transparent and flexible OLEDs will redefine automotive and architectural design. Companies that invest in sustainable materials and scalable production methods will lead the next phase of growth.

Conclusion and Strategic Insights

OLED display manufacturers are at the forefront of a technological revolution, driving innovations that span from foldable smartphones to transparent automotive displays. With global market revenue projected to reach $350 billion by 2028, the competition among manufacturers like Samsung, LG, BOE, and Visionox is intensifying. While challenges like material costs and environmental concerns persist, advancements in QD-OLED, hybrid tandem structures, and biodegradable materials are paving the way for sustainable growth.

For businesses seeking cutting-edge display solutions, partnering with leading OLED manufacturers offers opportunities to differentiate products and meet evolving consumer demands. Whether you’re designing next-gen wearables, reimagining automotive interiors, or exploring eco-friendly displays, the future of OLED technology is bright and full of possibilities.

Contact us to discuss tailored OLED display manufacturing solutions for your industry.

Latest articles

-

Why 1–2" AMOLEDs Are Key to AR/XR in 2025

Why 1–2 Inch AMOLED Displays Are Becoming Essential in the AR/XR Boom (2025 Industry Insight)body {f

-

Understanding OLED Display Technology: Principles, Performance & Applications

OLED (Organic Light Emitting Diode) displays are a class of self-emissive display technology in whic

-

From Wearables to AR Glasses – How OLED Displays Are Redefining Visual Experiences in 2025

By 2025, OLED (Organic Light-Emitting Diode) technology has transitioned from luxury smartphone disp

-

Stretched Bar LCD Displays for Retail: Boost Sales & Engagement in Supermarkets

Discover how stretched bar LCD displays enhance supermarket shelf-edge marketing, drive sales, reduc

-

Stretched LCD Solutions for Restaurants and Hospitality Venues

Stretched LCDs offer sleek, high-brightness displays perfect for restaurant menus and hospitality si

Recommended products

-

3.92 INCH OLED Screen I2C Interface 1080 × 1240 Resolution

Product Specifications: BRO392001AResolution: 1080x1024Operating Voltage Range: 28VScreen Size: 3.92

-

6.01 INCH Display OLED screen | High Definition 1080x2160 | MIPI Interface

Product Specifications: BRO601001ADisplayMode: AMOLED Screen Size (inch): 6.01 Resolution: 1080x2

-

6.39 INCH Outdoor AMOLED, 1080x2340, HD, High Brightness

Product Specifications: BRO639001AResolution: 1080x2340Voltage: 2.8VSize: 6.39 inchesDriver IC: SD52

-

5.48 INCH AMOLED Display Module - 1080x1920 I2C, MIPI DSI, Industrial

Product Specifications: BRO548001AResolution: 1080x1920Operating Voltage Range: 2.8VScreen Size: 5.4